Consumption and Economic Life

- Home

- Korean Culture and Life

- Consumption and Economic Life

Consumption and Economic Life

01Household Economy

(1)Household Economy

Household economy (household budget) refers to the status of your income and expenditures. Depending on how you budget, your household economy may show a loss or a surplus, even when your income is low.

(2)Monetary Value

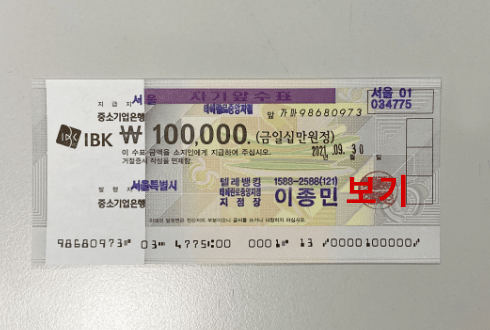

In Korea, both coins (KRW 10, KRW 50, KRW 100 and KRW 500) and bills (KRW 1,000, KRW 5,000, KRW 10,000 and KRW 50,000) are used. Bank checks with a value of KRW 100,000 or higher are also widely used.

- Coins

- < KRW 10

(Sip Won) > - < KRW 50

(O-Sip Won) > - < KRW 100

(Baek Won) > - < KRW 500

(O-Baek Won) >

- Paper Money

- < KRW 1,000 (Cheon Won) >

- < KRW 5,000 (O-Cheon Won) >

- < KRW 10,000 (Man Won) >

- < KRW 50,000 (O-Man Won) >

- < KRW 100,000 (Sip-Man Won) >

- Bank checks with a value of KRW 100,000 are widely used, and are as readily accepted as cash. To use a check, present the check with your ID card, and endorse (sign) the back of the check.

You should think about what you can do with 1,000 won, 5,000 won, 10,000 won and 50,000 won when you consider buying something by comparing the monetary value in Korea with the monetary value in your country.

-

A cup of coffee from a vending machine 300~500won

-

A bag of snacks or ice cream 1,000~2,000won

-

Meals such as rice with side dishes and naengmyeon 6,000~8,000won

-

Pork 500g 10,000won

-

A bag of rice (20kg) 55,000won

- Prices may vary depending on the region or the product.

02How to Purchase and Use Goods

If you shop without a list, you may find yourself buying a lot of things you don’t need, which, over time, can greatly impact your family budget. In order to curb excess spending, make a plan before you shop.

(1)Make a List

Make a list before you go shopping.

(2)Decide Where to Shop

Decide where and how much you will spend.

Convenience stores are open 24 hours and sell a diverse range of goods, including food. Since convenience stores are small, it is easy to find what you want. They can be useful when you need to buy one or two things.

Conventional markets are full of vendors selling food, clothing, and commodities. Goods can be bought at cheap prices, and there is room for negotiation on price and quantity. Conventional markets are also a good way to witness the lives of Korean people and experience Korean culture.

Supermarkets usually sell snacks, vegetables, meat and beverages. They are conveniently located around the neighborhood.

Department Stores sell diverse items including clothing, food, electronics, cosmetics, and jewelry. The facilities, services, and the quality of goods sold at department stores are excellent, driving up the prices. They frequently hold sale events, so it is better to wait and use these event periods.

Like department stores, large discount stores offer diverse items including food, clothing, electronics and commodities. The quality of products is excellent, and the facilities and the services are good.

It is possible to order products shown on TV via telephone or Internet. Home shopping items include clothes, groceries, cosmetics, electronics, and even insurance. TV home shopping is very convenient, but it is easy to buy items you don’t really need.

Online shopping malls allow you to place orders and purchase a wide array of items. One of the drawbacks though, is the items may look different on the screen than in real life. It is advised to look very carefully or consult the sales agent.

(3)Method of Payment

Payments can be made in cash or by check, credit card, debit card or gift certificate.

- < Credit card >

- < Gift certificate >

(4)Purchasing Goods

Compare the price and quality of goods, and check the expiration date of food products. Before making a large purchase, do some research to make sure you are getting a fair price. Keep your receipt in case you need to make an exchange or get a refund.

(5)Before Using Goods

- Keep the warranty card: Collect warranty cards and keep them in a safe location.

- Read the user manual: Read the manual to ensure that you are using the product correctly.

- Check notes and instructions: Check notes and instructions for safety and health.

- < Warranty card and manual >

(6)Refunds and Returns

- Do not use damaged products; return products with defects.

- Most vendors will require you to return goods within 7 days or 14 days in order to receive a refund, so ask family members or neighbors for assistance immediately if you notice a problem with an item you have purchased.

- If you have difficulties getting a refund or experience other difficulties with your transaction, you can seek help from the Korea Consumer Agency or other consumer-related organizations.

Consumers Korea : ☎ 02-739-5441, www.consumerskorea.org

03How to Save Money and Use Banking Services

(1)Necessity of Savings

Saving is necessary in order to be able to own property, prepare for unexpected disasters and future retirement, buy a house, pay for your child’s tuition, etc. To start saving money, open an account at your local bank.

(2)Kinds of Saving Accounts

- Regular Savings: Accounts with low interest rates in which you can freely deposit and withdraw money.

- Term Deposit: Accounts with a higher interest rate in which you deposit a large amount of money for a specific term.

- Installment Savings: A high-interest account requiring a fixed deposit amount each month; a large withdrawal can be made at the end of the term.

- Free Deposit and Savings: This new method of savings offers a high interest rate for long-term savings and aims to apply preferential rates to household savings.

(3)How to Use Banking Services

How to Open a Bank Account

- Things you will need: identification card (passport, alien registration card, resident registration, etc.), seal (stamp), money to deposit

- Instructions

- 1Upon entering the bank, take a number and wait until the number is called.

- 2Go to the desk when the number is displayed on the display board.

- 3Explain your purpose for visiting to the bank teller (bank account opening, remittance, deposit, etc.). Ask for a debit card if necessary.

- Debit card: Debit cards can be used to make a deposit or withdrawal at an ATM without a bankbook and/or seal.

- 4Fill in the forms and submit them as directed by the bank teller.

- 5 Keep your bankbook and debit card in a safe place.

- Do not disclose your password to others.

Bank Hours

- Monday through Friday: 09:00-16:00

- Outside of Bank Hours: Use ATM located in bank lobby

Deposit and Withdrawal

- Bank Teller·Prepare the application for deposit or withdrawal, and go to the teller's counter. A PIN (Personal Identification Number) is not required to make a deposit, but must be provided to make a withdrawal.

- An Automated Teller Machine (ATM) can be used with a bankbook or cash card. You must enter your PIN to make a transaction. If you enter the wrong PIN 3 times in a row, you will not be able to make the transactions (inquiry, deposit, or withdrawal). ATM transactions are also subject to fees if used outside of the bank's business hours, or used at another bank.

- < ATM >

Internet Banking

- Internet banking refers to banking services provided via the Internet.

- Online banking allows you to check account balances, check the history of deposits and withdrawals, and make remittances using your own bank accounts.

- To apply for internet banking, you will need an authentication certificate, issued online at the Korea Financial Telecommunications and Clearings Institute, and a secret card and One Time Password (OTP) card issued from your bank. Please visit your bank for more information.

Mobile banking is a service provided by a bank or other financial institution that allows its customers to conduct financial transactions remotely using a mobile device such as a smartphone or tablet. It can be used on the move, which is advantageous in that it is not restricted by location compared to Internet banking.

How to Pay Utility Bills

- Direct payment

Bring the bill to a financial institution and pay directly. At many banks, tellers do not assist you in paying utility bills. In this case, use the automated machines in the bank. To use these machines, you need to have an account at the bank.- Note: In case you do not have an account, it is possible to pay the bills at a post office.

- Automatic withdrawal

Set a date for when each bill will be withdrawn from your account. Automatic withdrawal can be arranged by visiting your bank or by calling your service provider. Be sure to remember the withdrawal date and leave enough money in your account to cover the bill.

Remittance

- Have an account made in your home country by your family.

- Prepare the following information accurately: name of the recipient, address, phone number, name of the bank, and his/her bank account number, and visit the foreign exchange section at your bank and present your ID card to the teller.

- Keep the recipient of remittance.

Using public banking agencies such as banks and post offices is the safest way to remit money overseas. Many people use private service providers (or brokers) rather than banks to remit money. Even though these services are faster and simpler, you use these services at your own risk. Cases of brokers disappearing with the remittance money are not rare. In these cases, there is no way to get your money back; as such, it is highly recommended that you use public institutions to send money overseas.

Voice phishing is a fraudulent act in which false information is sent to people via phone or SMS in order to get them to send cash or a make a deposit to a scammer.

Fraud by impersonating a buddy through a messenger program

In these cases, a criminal learns the online messenger ID and password of a third party, logs in using the information, and asks a family or friend registered on the person’s contact list to send money for an "emergency”. If the victim sends money, the criminal simply runs off with it.

Fraud by deceiving a victim with a false emergency notice SMS from the Financial Supervisory Service, asking the victim to visit a phishing websites

In this type of case, a criminal sends a message that appears to be a notice sent by a financial firm or the Financial Supervisory Service. When the person visits the website sent by the scammer, he is prompted to enter his personal financial information. The scammer then uses this information to secure a loan.

Fraud by acquiring telebanking information over phone

In this type of case, a criminal targets a senior citizen in their 50s to 70s that has subscribed to a telebanking service, or tries to get the senior citizen to subscribe to a telebanking service. The criminal acquires telebanking information (resident registration number, PIN code for remittance, PIN code of the bank account, serial number of the security card and the security codes on the security card) under the pretext of preventing or responding to a report of ID abuse, data leakage, or other criminal activities. The scammer remits money from the victim's account to his or her account.

Fraud under the pretext of kidnapping or an accident involving a child

In this type of fraud, a criminal who knows the telephone number of a child and his/her parents falsifies the caller number to make it appear as though the child has had an accident or was kidnapped, in order to blackmail the parents. The criminals usually defraud the parents under the pretext that a child going to school has been kidnapped, a son performing his military service has had an accident, or a child studying overseas has had an accident or has been kidnapped.

Fraud by deceiving a victim into handing over the victim's money at ATM machines

A criminal calls a victim, impersonates an employee of an investigating organization, sends the victim to an ATM under the pretext of involvement in a crime (an accident), and gets the victim to send money to the criminal's account.

Fraud of card loan using ARS after the acquisition of credit card information

A criminal acquires the credit card information of a victim (credit card number, PIN code and CVC) under the pretext of responding to ID abuse, data leakage or other criminal activities. The criminal uses the card to get a loan in the name of the victim using ARS, while calling the victim to report that the crime funds had been remitted to the account of the victim and making the victim remit the money to the criminal's account.

To report these or similar crimes, please call

The Police (☎112), KISA (☎118) or the Financial Supervisory Service (☎1332)